Prices keep rising while conditions continue to favour the seller.

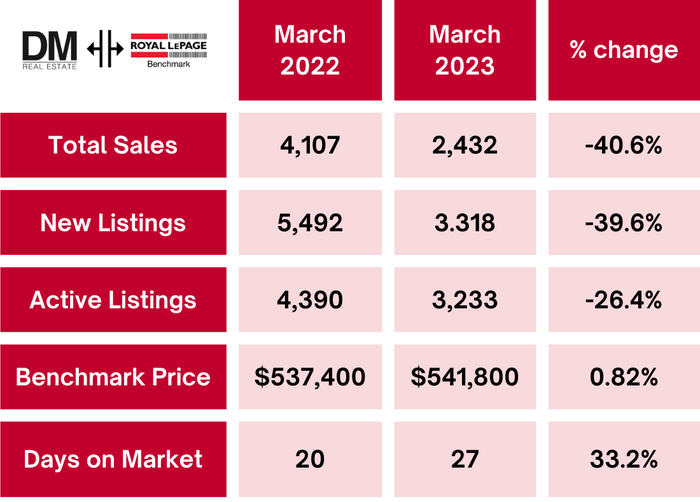

It's heating up out there and I'm not just talking about the sun, Calgary's spring market is in full swing! As the weather warms up and the snow starts to melt, just like the bears, we see more and more people emerging from hibernation and ready to take on new projects, set goals, and really channel that revival energy that comes with the season. Real estate is typically one of those sectors that gets a boost during this time as people like to make a change and this year is no exception, the market is active but is definitely limited by its inventory and that's the issue you may be encountering as a buyer in this market. If you're thinking about selling, this might be a great opportunity for you to capitalize on a market that is tending to favour the seller for certain segments of the market. In all of Calgary there were only 3,233 available units available which reflected the lowest March inventory levels since 2006 leaving a lot of power in the seller’s territory. While conditions are not as tight as last March, low inventory levels leave purchasers with limited choice, once again driving up home prices.

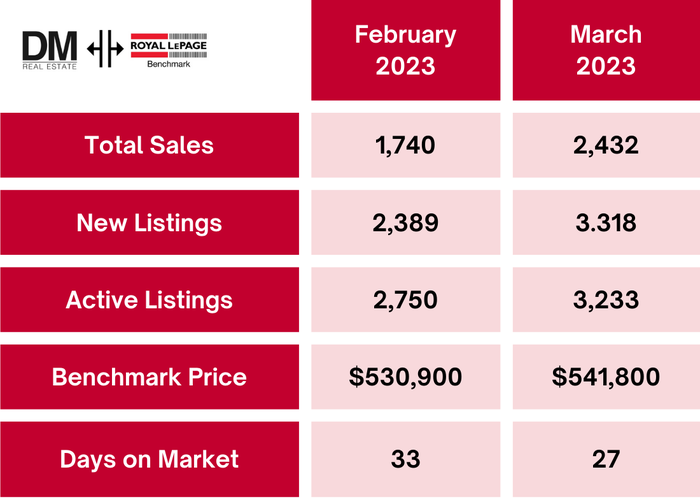

In all of Calgary there were only 3,233 available units available which reflected the lowest March inventory levels since 2006 leaving a lot of power in the seller’s territory. While conditions are not as tight as last March, low inventory levels leave purchasers with limited choice, once again driving up home prices.Total unadjusted residential home prices reached $541,800 in March, a 2% gain over last month and nearly 1% higher than prices reported last year. While prices remain below the May 2022 high of $546,000, the pace of price growth over the first quarter has been stronger than expected due to the persistent seller’s market conditions.

CREB chief economist Anne-Marie Lurie mentions “The challenge has been centered around supply. As a result, existing homeowners may be reluctant to list as they struggle to find an acceptable housing alternative in this market. At the same time, higher lending rates can also reduce the incentives for existing homeowners to list their home.”

Overall, March recorded 3,318 new listings compared to the 2,432 sales, leaving the sales-to-new listings ratio relatively high at 73 per cent. At this time last year, there were 5485 new listings with 4364 sales. This year’s numbers are significantly lower than March 2021 and when there’s limited inventory and many buyers it can make things a bit more chaotic. More buyers tend to emerge at this time of year so now is a great time to sell.

Overall, March recorded 3,318 new listings compared to the 2,432 sales, leaving the sales-to-new listings ratio relatively high at 73 per cent. At this time last year, there were 5485 new listings with 4364 sales. This year’s numbers are significantly lower than March 2021 and when there’s limited inventory and many buyers it can make things a bit more chaotic. More buyers tend to emerge at this time of year so now is a great time to sell.For the detached house market, the persistently tight market conditions have contributed to further price growth. In March, the detached benchmark price reached a new record high at $649,800. Conditions are much tighter at the lower end of the market as supply levels have shifted. Nearly 63 per cent of the new listings that have come onto the market so far this year are priced over $600,000, much higher than the 48 per cent reported last year.

In the semi-detached market, like other property types, sales and new listings reported a significant drop over last year’s levels, leaving the market exceptionally tight with a sales-to-new listings ratio of 78 per cent in March. In addition, higher lending rates have driven many purchasers to seek semi-detached properties. However, conditions remained exceptionally tight for properties priced below $600,000. Low inventory levels have driven prices up reaching an unadjusted benchmark price $581,300 for March, 2% higher than February.

For the Row housing sector, new listings and inventory levels have all trended up compared to levels seen at the beginning of the year, like other sectors, property levels are much lower than they were last year. Low supply levels continue to favour the seller and tight market conditions also placed further upward pressure on prices. The benchmark price for March rose to $378,100, reflecting a year-over-year gain of nearly 8% and representing a new monthly record high.

For the Condo market, it was reported that there were 682 apartment condominium sales, a decline of 11 per cent over last year’s record high. New listings also eased by eight per cent compared to last year, keeping inventory levels relatively low at about 1000 units. Inventory numbers remain low and the market continues to favour the seller. The benchmark price in Calgary reached $293,500, a year-over-year gain of nearly 11 per cent. The recent increase in price is shifting this market closer to full price recovery like when prices reached a monthly high back in November 2014 at $306,600.

This is simply a general overview of what's happening in Calgary's market as a whole, if you'd like to know how your neighbourhood is doing, reach out and I'd be happy to give you a more detailed overview with specific numbers for your street and neighbourhood.

Keeping you connected to Calgary's Real Estate Market

---Claire